Growth, Inflation, and Interest Rates:

The consensus view on Wall Street is that COVID19 has caused an acute deflationary bust in 2020 and that general uncertainty regarding the virus will continue to stifle demand for at least 12-18 months. Additionally, most financial pundits argue that ‘QEternity’ will NOT cause inflation, as evidenced by the fact that the post-GFC fears of runaway inflation caused by quantitative easing never came to pass.

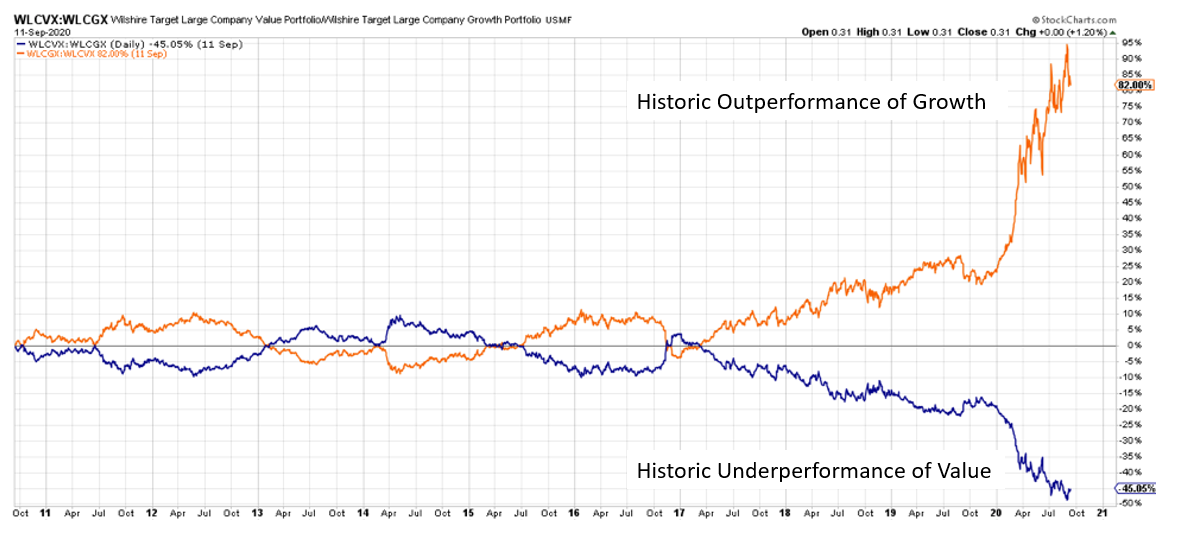

Thus, from an asset allocation perspective, they are positioning for a gradual return to a prolonged period of slow economic growth supported by accommodative monetary policy, low inflation, and low interest rates which means investors should continue to remain overweight large cap growth and bond-proxy equities. This is despite the recent outperformance of Growth over Value that is without historical precedent.

Q. Is the consensus view that Growth will outperform Value? A. Yes.

Hedging the Risk of Reflation:

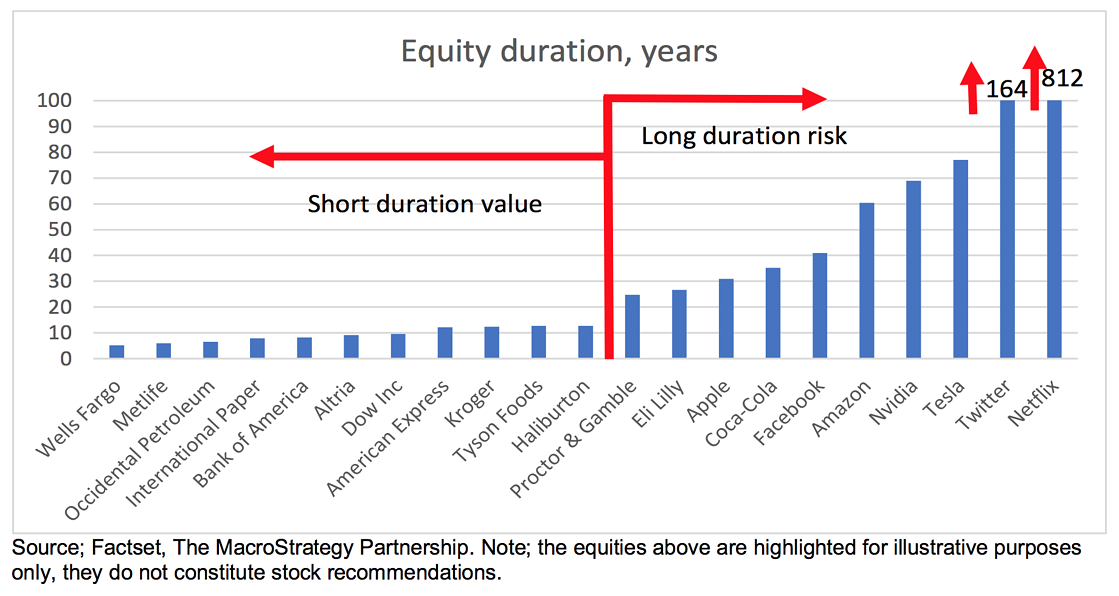

According to The Macro Strategy Partnership, “Long duration tech and quality growth stocks are much riskier propositions in a reflationary recovery than investors realize. The biggest risk comes from a potential rise in 10-year yields into the reflationary recovery, and an increase in the equity risk premia as inflationary pressures start to build.” Said differently, should the consensus view not materialize, and the global economy recover faster than expected, even a whiff of inflation could spark a violent rotation out of long duration risk assets.

As fiduciaries, it is incumbent upon us to consider and hedge our client-capital against a consensus view that may never come to pass, and this is especially true if that protection is incredibly inexpensive in a historical context. The best way to do this today is to allocate a portion of one’s portfolio to short duration value stocks that stand to benefit from an economic recovery—particularly if it’s a recovery that produces above-trend inflation—such as industrials, financials, materials, and other commodity-type businesses.

Q: Should investors employ inexpensive hedges against unexpected reflation/inflation? A: Yes.

Buying Cheap Calls on the Recovery:

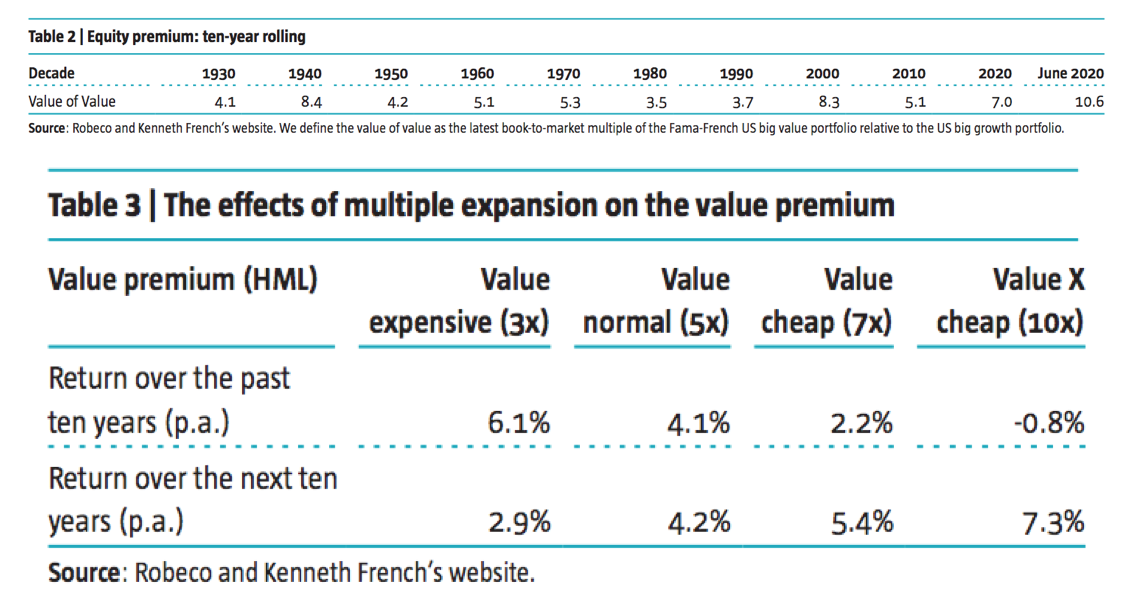

In a recent white paper, the investment firm Robeco argues that even when Value is not generating excess returns it still reduces long-term portfolio risk. Their research found that the valuation—defined as the ratio between the book-to-price multiples of US Value and Growth portfolios—of the value-premium was significant from the standpoint of expected returns.

When looking at rolling ten-year periods, it is clear that there are periods when the ‘value of Value’ is relatively cheap or expensive versus its growth counterpart, “For example, in January 2010, ‘value’ stocks offered 5.1x more value than ‘growth’ stocks…As of June 2020, this multiple had hit a remarkable 10.6x, indicating that value stocks are offering extreme value.” Historically, when the ratio reached similar levels, the excess returns to Value have been over 7% per annum over the following decade.

Q: Does the timing look right to allocate to Value from a historical standpoint? A: Yes.

To summarize our thesis:

- The consensus view: disinflation and low interest rates favor long duration growth stocks over short duration value stocks

- Thoughtful investors should hedge against a reflationary recovery

- Value itself has never been this cheap in historical terms

What differentiates Masonry is our ability to seek opportunities throughout the capital structure, unconstrained by market cap, and across the investment spectrum from quality growth to deep value.

We are currently buying short duration value stocks trading in many cases below 3x normalized earnings, positioned to benefit from an economic recovery, and characterized by the ability to return substantial amounts of capital to shareholders over a full cycle.