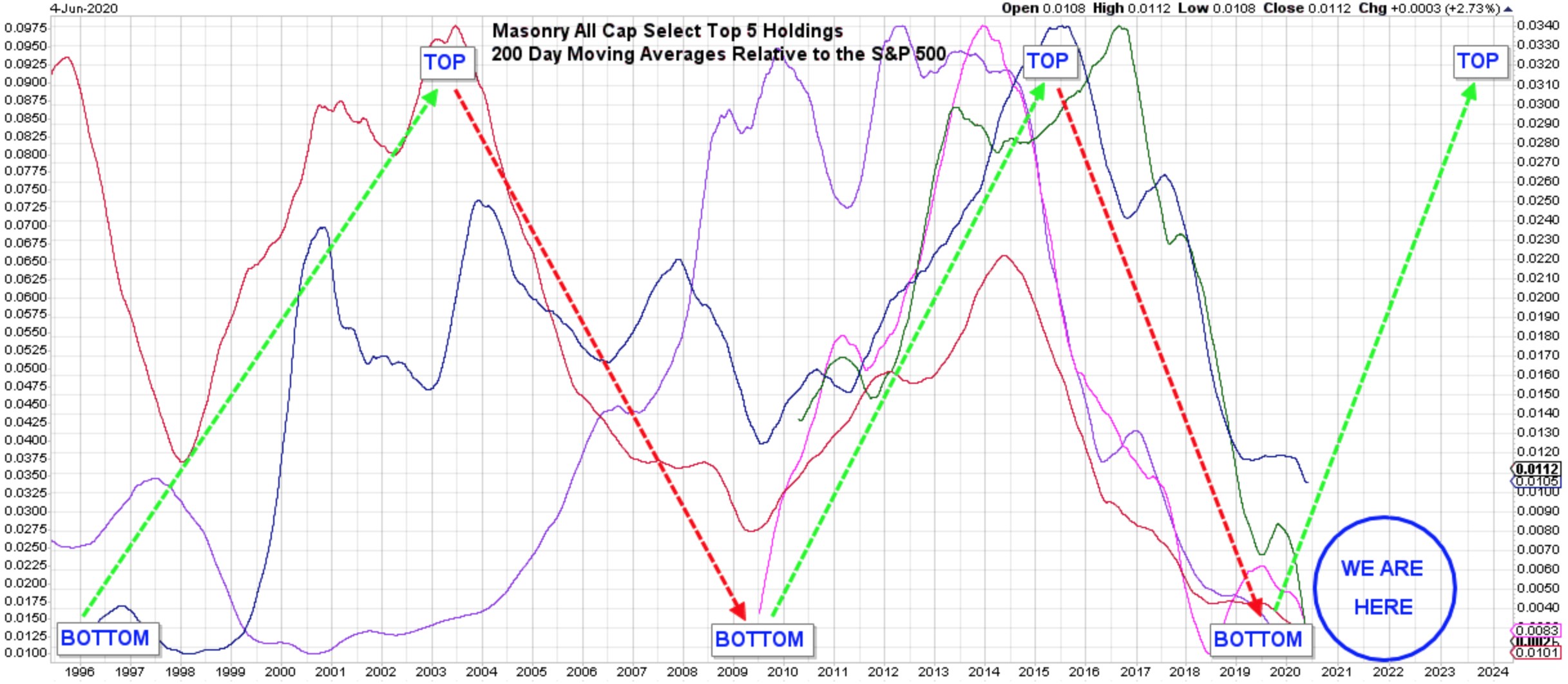

Chart 1: Top or Bottom?

Over the past 25 years, the performance of Masonry All Cap Select’s (MACS) top 5 holdings relative to the S&P 500 has exhibited an undeniable and recurring cycle.

Q: Do we appear to be near the bottom of the cycle? A: Yes

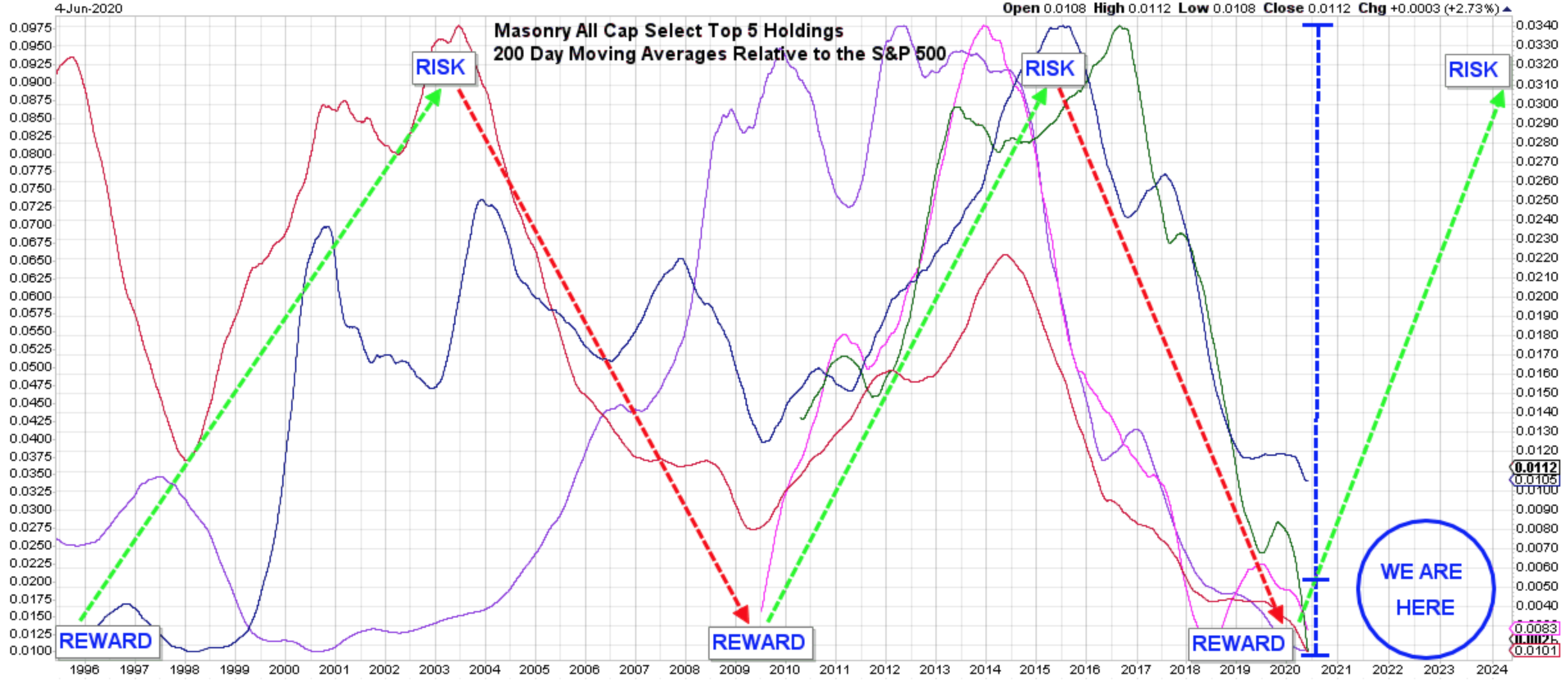

Chart 2: Risk or Reward?

Over the past 25 years, investing in these businesses near the bottom of the cycle offered an asymmetric opportunity.

Q: Does the risk/reward profile look attractive? A: Yes.

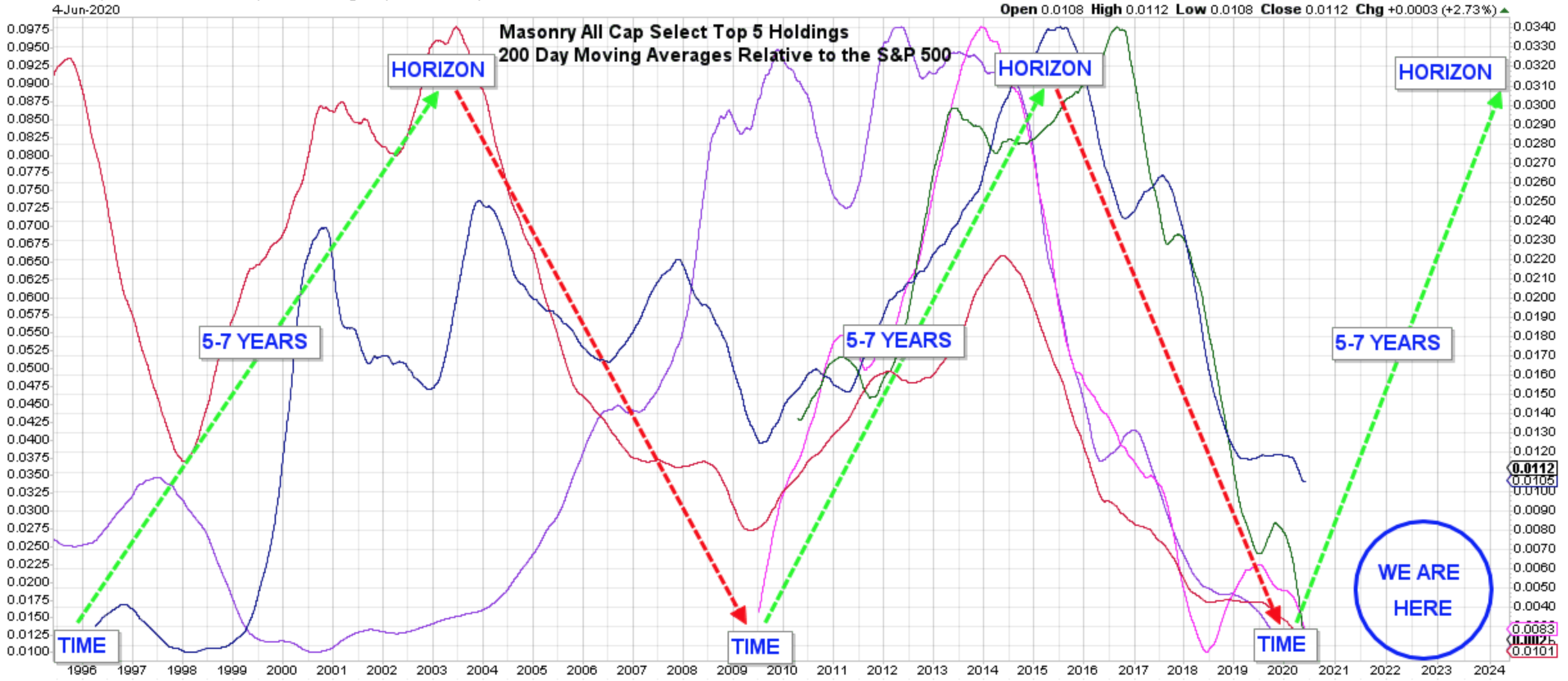

Chart 3: Now or Never?

Over the past 25 years, one could have maximized the opportunity by investing near the bottom of the cycle and holding for 5-7 years.

Q: Does the timing look right if you have a 5-7 year horizon? A: Yes.

How and why this matters:

We believe the current setup is better than average. The opportunity lies in identifying and purchasing stocks that exhibit the right economics at extraordinarily cheap valuations near cyclical lows in performance relative to the S&P 500.

Masonry All Cap Select’s top 5 holdings are positioned to capitalize on several long-term secular trends such as 5G technology, streaming entertainment, energy transportation, and other evolving consumer demographics. These are all well-known trends, but what makes Masonry unique is our commitment to finding and investing in companies that are off the beaten path where valuations are cheap and the margin of safety is high.

This contrarian approach means we do not express our thesis by mindlessly buying large-cap growth stocks such as AMZN or NFLX (you can easily place these bets yourself or buy an index fund), or attempting to exploit short-term superficial representations of these trends by gambling on many of the hope-and-hype cloud stocks.

Instead, we actually do the fundamental research necessary to find great investments with highly favorable risk/reward characteristics where the long-term probability of success is skewed in our favor. We are value investors, not Luddites. We’re good people with sharp pencils who are doing the work required.

To summarize our thesis: In the context of our top 5 holdings (34% of total portfolio) we are near the bottom of the current cycle, the risk/reward scenario is highly attractive, and the opportunity will be greatest over a 5-7 year holding period.