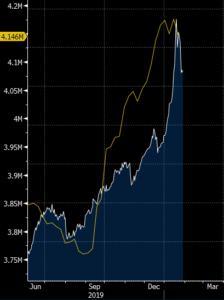

There’s been a plethora of articles in the financial press lately about the tight correlation between the recent expansion of the Fed’s Balance Sheet and the subsequent increase in the price of risk assets. The chart below is just another example. It highlights the price movement of Palladium (white line) with the Fed’s Balance Sheet (yellow line) which started expanding in mid-September as a response to turmoil in the repo market. Viewed in the context of the headline this morning on Bloomberg, “Palladium’s Biggest Miner Says Market Is In a Bubble,” it’s not hard to see that the Fed’s actions are having a substantial, but possibly fleeting, impact on the price of financial assets.