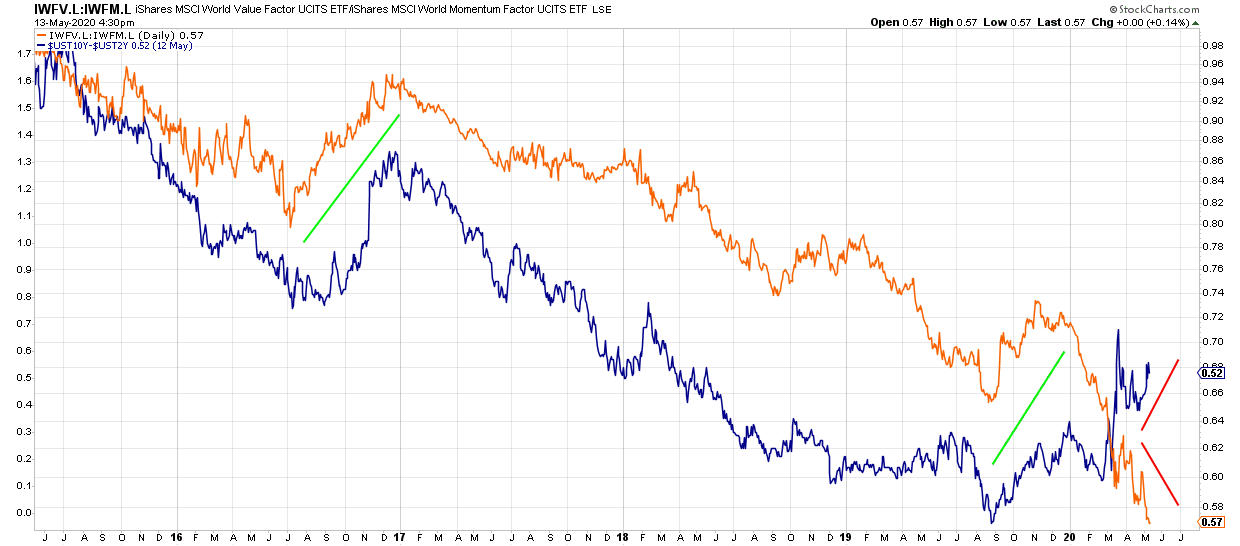

Above is a 5-year chart of (10-2 Spread) in Blue; overlaid with (Value/Momentum) in Orange.

When the 10-2 Spread widened significantly in 2016 and 2019, Value outperformed Momentum by a wide margin.

All else equal, this correlation makes sense as it pertains to spreads and the PV of future cash flows. Historically, this is less of an emotional fear/greed trade and more of a simple mathematical relationship (which is why it held up as recently as late 2019).

This relationship seems to have broken down after the March COVID-19 intervention by the Fed…and we could be witnessing a ‘Mungarian Lollapalooza’ in that Value and Momentum have decoupled from the 10-2 Spread for opposite reasons: Momentum is trading on GREED, Value is trading on FEAR.

This may be one of the reasons why, as spreads have recently widened, the Value/Momentum trade has not yet reversed.